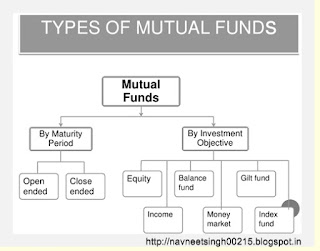

There are three types of schemes offered by the MF's :-

- Open-ended Schemes :- An open-ended fund is the one which is usually available from a mutual fund on an ongoing basis, that is an investor cab buy or sell as and when they intend to at a NAV-based price. As investors buy and sell units of a particular open-ended scheme, the number of units issued also changes every day and so changes the value of the scheme's portfolio. So, the NAV also changes on a daily basis. In India, fund houses can sell any number of units of a particular scheme, but at times fund houses restrict selling additional units of a scheme for some time.

- Closed-ended Schemes :- A close-ended fund usually issue units to investors only once, when they launch an offer, called new fund offer (NFO) in India. Thereafter, these units are listed on the stock exchanges where they are traded on a daily basis. As these units are listed, any investor can buy and sell these units through the exchange. As the name suggests, close-ended schemes are managed by fund houses for a limited number of years, and at the end of the term either money is returned to the investors or the scheme is made open ended. However, there is a word of caution here that usually, units of close ended funds which are listed on the stock exchanges, trade at a high discount to their NAV's . But as the date for closure of the fund nears, the discount between the NAV and the trading price narrows, and vanishes on the day of closure of the scheme.

- Exchange - Traded Funds (ETF's) :- ETF's are a mix of open-ended and close-ended schemes. ETF's like close-ended schemes, are listed and traded on a stock exchange on a daily basis, but the price is usually very close to its NAV, or the underlying assets, like gold ETF's.

No comments:

Post a Comment